CLAIM:

The Sunday Mail this week reported that Zimbabwe’s bank note shortage would ease, following US$400 million cash imports by the central bank since the beginning of the year, as well as improvements in the production and sale of key commodities – gold and tobacco.

Factchecked by Nelson Banya

ROOT OF THE PROBLEM

Zimbabwe’s current bank note crisis intensified in the first quarter of 2016, when long lines re-emerged at the banks for the first time since 2009 when the country abandoned its currency for the United States dollar, South Africa’s rand and other foreign currencies in a bid to tame hyperinflation.

While the authorities attribute the bank note crisis to the smuggling of physical bills from the country as well as a widening trade deficit, economic analysts also add unrestrained government spending to the list of causes.

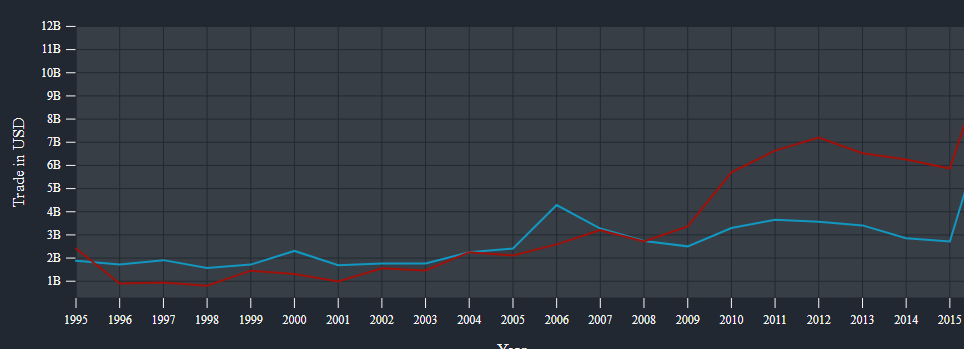

Since dollarization in 2009, Zimbabwe has shipped out US$31 billion to pay for imports, against cumulative export receipts of just over US$20 billion for the period.

Zimbabwe’s cumulative imports since 2009 reached US$31 billion in 2017, against US$20 billion exports over the period

The country has lost significant production capacity, partly due to its industries’ inability to recapitalise and due to the relative strength of its adopted currency – the United States dollar – against major trading partners, especially South Africa.

When Zimbabwe dollarized in 2009, the United States dollar was worth just under 10 South African rands. The rand weakened significantly, nearly touching 17 to the greenback in January 2016, further eroding the competitiveness of Zimbabwean products against those originating from its biggest trading partner.

The rand’s weakness has also diminished its acceptability as a medium of exchange in Zimbabwe. In 2009, rand use rivalled that of the greenback, with each currency accounting for about 45 percent of domestic transactions each. By 2016, virtually all local transactions were being conducted in United States dollars.

State spending has also spiralled, with government raking up a cumulative budget deficit in excess of $3 billion between 2014 and 2017, funded through its debt security of choice – Treasury Bills issued to banks.

“As the principal and interest payments on these government securities are settled on the RTGS (real-time gross settlement system), it is clear that the government has been using the issuance of this debt to effectively print money,” London-based Exotix Capital Partners wrote in a 2016 note on Zimbabwe’s currency crisis.

In effect, government had sucked hard currency out of the banking system, replacing it with electronic balances, Exotix, an investment banking and advisory firm focusing on emerging markets, noted.

Bank balances with the RBZ, which stood at $112 million in January 2010, had risen to $2,6 billion by December 2017. Meanwhile, balances with foreign banks, which averaged US$500 million before the crisis, were down to about US$200 million in December 2017.

Bank lending to government, which resumed in 2012, reached $2,4 billion at the end of 2017.

GOVERNMENT’S RESPONSE

In a bid to arrest the problem, the RBZ imposed cash withdrawal limits in May 2016, while reducing the cost of electronic banking.

Government has also sought to improve the country’s export performance, while throttling imports.

As a consequence of the crisis and government’s measures to promote alternative payment methods, the central bank says about 95 percent of all retail transactions are not going through electronic channels.

However, the most significant move taken by government in response to the bank note crisis has been the introduction of a parallel currency – bond notes and coins – in a bid to ease the shortage of physical currency. The ‘bond’, which the central bank says is not a currency but a financial instrument, is pegged at parity with the United States dollar, although it trades at a 20 percent discount against the greenback on the informal market.

The bond notes and coins derive their name from the bond facilities, advanced by the African Export Import Bank (AfreximBank), backing their issuance.

The central bank says it has so far issued $350 million in bond notes and $90 million worth of coins, against facilities worth more than US$500 million from the AfreximBank.

The introduction of the bond notes has shaken the banking public’s confidence in the financial system, further compounding the problem.

Despite the authorities’ protestations to the contrary, the introduction of the bond notes has stoked fears of a return of a local currency and the memories of a Zimbabwean dollar ravaged by hyperinflation.

As part of its response to the bank note crisis, the central bank has also stepped up the importation of physical bills, as reported by The Sunday Mail.

WILL THE CASH IMPORTS EASE THE CRISIS?

Last year, the central bank reported that it had imported US$100 million between January and June 2017, with private banks weighing in with US$40 million.

RBZ governor, John Mangudya, told The Sunday Mail that the central bank had scaled up its bank note imports in the first four months of 2018:

“I can say that we have imported cash of an amount of about US$400 million from January to the end of April.

This is higher than what we did last year at around the same time,” Mangudya told the newspaper.

However, although the physical dollar imports have averaged US$100 million so far this year, compared to the monthly average of just over US$23 million last year, cash issued at automated teller machines (ATMs) has averaged $4,22 million per week in the first 18 weeks of 2018, compared to $13,44 million per week over the same period of 2017, according to RBZ data.

The data shows that cash access from ATMs averaged $56 million a week over the same comparative period of 2014, $71 million in 2015 and $69 million in 2016.

CONCLUSION:

Although the RBZ’s increased level of bank note imports, combined with tobacco sales receipts and a reported jump in first quarter gold production will improve the availability of foreign currency, it is misleading to report that “cash shortages will ease in coming weeks.”

This is because the US$400 million cited is already in the economy, with no discernible impact on the bank note shortage situation.

This is also because the economic fundamentals cited by Mangudya for the persistent foreign currency crisis – the twin trade and budget deficits – remain unresolved.

Although Zimbabwe’s primary mining and agriculture sectors have shown signs of stirring, the manufacturing sector is still some way away from recovery, meaning the trade deficit will take some time to plug.

Efforts to rein in government spending have also been complicated by wage increases awarded to state employees in recent months.

Nelson Banya is Deputy Editor of ZimFact

Do you want to use our content? Click Here