CLAIM:

President Emmerson Dambudzo (ED) Mnangagwa, who has positioned himself as a pro-business president since his November 2018 inauguration, has indicated that his ascension has coincided with an increase in investor interest in Zimbabwe.

Factchecked by Nelson Banya

On February 8, 2018, the Herald newspaper quoted Mnangagwa saying:

“We have secured more than $3bn in foreign direct investment in just seven weeks. We want this country to move forward. We want jobs for our children. For a start, we are addressing the production levels of agriculture where we are modernising all forms of production. We will move into modernising the processing chain.”

Addressing a church gathering in Shamva on April 25, 2018, Mnangagwa announced that investment commitments to Zimbabwe had increased to $11 billion.

The Zimbabwe Broadcasting Corporation (ZBC) quoted the president, who is routinely referred as “ED” by the local media, as saying:

“For the past four months, we have been discussing and realised that investment commitments have passed $11 billion as companies are angling themselves for mutual benefit.”

FDI defined:

The International Monetary Fund’s Balance of Payments and International Investment Position Manual (BPM6) defines foreign direct investment as international investment by an entity resident in one economy in an enterprise resident in another economy that is made with the objective of obtaining a lasting interest.

The lasting interest implies the existence of a long-term relationship between the direct investor and the enterprise and a significant degree of influence on the management of the enterprise.

Direct investment involves both the initial transaction that establishes the relationship between the two entities and all subsequent capital transactions between them and among affiliated enterprises, both incorporated and unincorporated.

According to the IMF, a direct investment enterprise is an incorporated or unincorporated enterprise in which a direct investor that is resident of another economy has 10 percent or more of the ordinary shares or voting power (for an incorporated enterprise) or the equivalent (for an unincorporated enterprise).

The direct investor may be an individual, an incorporated or unincorporated private or public enterprise, a government, or an associated group of individuals or enterprises that has a direct investment enterprise in an economy other than that in which the direct investor resides. The ownership of 10 percent of ordinary shares or voting power is the criterion for determining the existence of a direct investment relationship.

Investment approvals versus commitments

The Zimbabwe Investment Authority (ZIA), the state agency responsible for overseeing and licencing foreign investment into the country, routinely provides information on the value of projects it would have approved. However, ZIA does not provide data on actual investment, within the boundaries of the IMF definition of FDI.

Nevertheless, ZIA’s statistics of projects licenced in the first quarter of 2017 show a wide gap between commitments claimed by Mnangagwa and approved FDI investments.

ZIA chief executive Richard Mbaiwa told journalists at the Zimbabwe International Trade Fair that the agency had licenced projects worth about $950 in the first quarter of 2018.

The Herald quotes Mbaiwa saying:

“The enquiries that have come to ZIA have increased very significantly. If I look at the first quarter of 2018, comparing to the first quarter of 2017, you see a very significant increase.

“In terms of projects that we have actually licensed, not those that made commitments such as the $4,2 billion by Karo Resources and others and not licensed by ZIA, I am not including those; I mean the ones ZIA has actually licensed, for the first quarter we are standing at just below a billion dollars.

“The figure (for licensed projects) is about $950 million. In the first quarter of 2017 we were at about $150 million. So, you can see the difference, the jump. Normally, the first quarter is the slowest, especially in the previous years. When we had $150 million in the first quarter, by end of the year the figure would have gone up to between $1,5 billion and $2 billion,” he said.

“So we think that this year, with the first quarter just shy of a billion dollars, we are quite positive that by end of the first quarter maybe we would have already surpassed last year’s total figure ($1,2 billion project approvals for whole of 2017).

Expected Direct Investment (EDI) versus actual FDI

Mnangagwa’s presidency has indeed seen a notable increase in foreign investor interest, as shown by several high-profile visits by investors, who include the chief executive of multi-billion dollar British development financier Commonwealth Development Corporation, Nick O’Donohoe, mineral fertilizer mogul Dmtry Mazepin, rated the 61st richest Russian by Forbes in 2015, Sergey Ivanov Jr, the chief executive of the world’s number two diamond miner Alrosa and mining entrepreneur Loucas Pourolis, chairman of the London and Johannesburg-listed Tharisa plc. Pouroulis signed a $4,2 billion deal with the government, to develop a platinum mine and refinery in the country.

In February, a high-level delegation from US multinational conglomerate General Electric visited the country and expressed interest in the 2 400 megawatt Batoka hydropower project, which is estimated to cost $4 billion.

During his April state visit to China, Mnangagwa also met Xiang Guangda, with the president’s aides announcing that Xiang’s Tsingshang Holdings – which lays claim to being China’s second biggest stainless steel manufacturer – was interested in setting up a $4 billion steel plant in Zimbabwe.

Xiang already has interests in Zimbabwe through ferrochrome firm Afrochine Smelting, which was set up in 2012. In 2013, the Chinese firm was reported to be planning to invest in a power plant that would generate as much as 1 000 megawatts to supply its Selous plant, with the surplus power being fed into the national grid. Five years on, it remains unclear if Afrochine is still pursuing the power project.

In an article he wrote for the Sunday Mail, presidential spokesman George Charamba suggested Xiang’s power plant ambitions had been frustrated by the previous administration:

“But he (Xiang) has been knocking on Government offices for the past three years, to no avail. Still, he didn’t give up on us.

“In that 30-minute meeting (with Mnangagwa), the investor was able to walk away with concrete commitments on all his requirements, opening the way for an early start to the project.”

Another Chinese billionaire Zhang Li, who is considering investing over $1 billion in the Zimbabwe Iron and Steel Company, also returned, having first come to Zimbabwe in October, 2017, when he was hosted by former President Robert Mugabe.

ZIA statistics of licenced projects, juxtaposed with data from the United Nations Conference on Trade and Development (UNCTAD), reveal a significant variance between FDI approvals and actual investment.

The UNCTAD publishes an annual report on global investment, which provides details of FDI trends at the national, regional and global level. The UNCTAD’s World Investment Report is a widely used resource for FDI data.

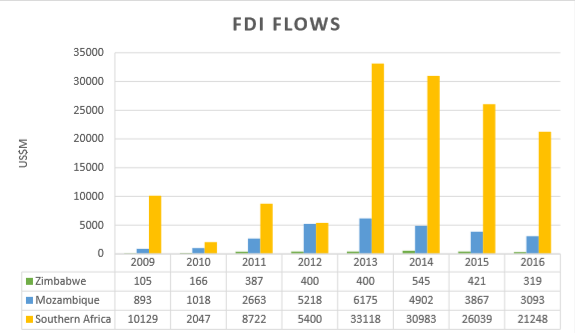

While ZIA has approved projects worth an average $1 billion annually over the past few years, Zimbabwe’s FDI has averaged $400 million since 2013.

CONCLUSION:

While ZIA data shows an increase in investor interest in Zimbabwe, with $950 million worth of approved projects comparing favourably with the annual average value of approvals in previous years, there is no evidence to back up Mnangagwa’s February claim, made at a Guruve rally, that the country secured more than US$3 billion in FDI in seven weeks as reported by The Herald.

In subsequent pronouncements, Mnangagwa appears to be cautious as he talks about FDI commitments, not secured investment.

As the ZIA and UNCTAD statistics show, approved projects and actual FDI investments vary significantly. As such, commitments to invest demonstrate interest but do not paint the whole picture.

Author: Nelson Banya is Deputy Editor of ZimFact

Do you want to use our content? Click Here