By ZimFact

Zimbabwe ended a decade of official use of the United States dollar in most domestic transactions in June 2019, introducing a local currency abandoned in 2009 after it had been ravaged by hyperinflation.

The reintroduced Zimbabwe dollar currently has $2 coins and $5 bank notes, which a circulating alongside bond coins and notes introduced in 2016.

Government says it will issue higher denomination notes – $10, $20 and $50 – this year in a bid to end a bank note crisis which emerged late 2015.

Here, ZimFact provides a pictorial sequence of Zimbabwe’s currency evolution since independence in 1980.

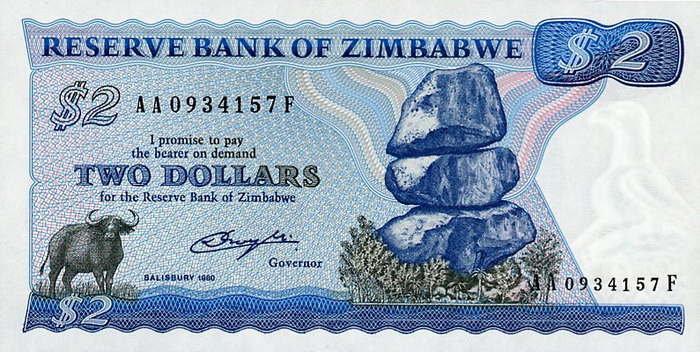

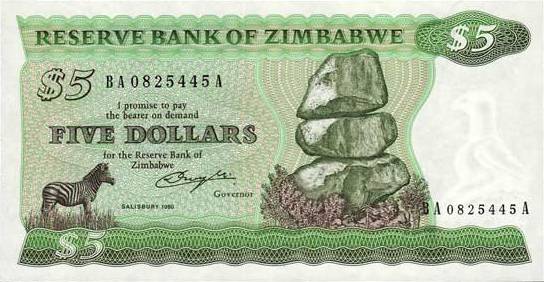

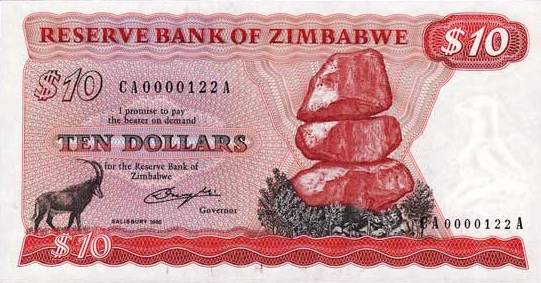

The Desmond C. Krogh ZWD series: (1980-1983)

The new republic’s first set of bank notes carried the signature of Desmond C. Krogh, the last governor of the Reserve Bank of Rhodesia, who occupied that position in newly independent Zimbabwe for three years.

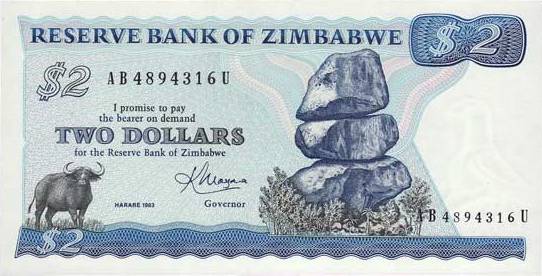

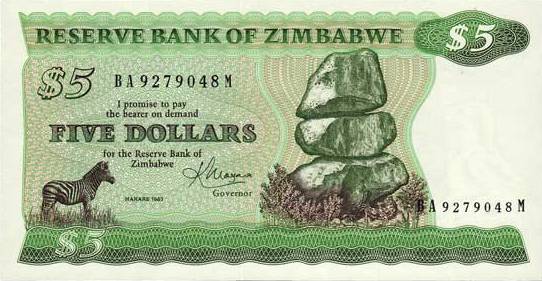

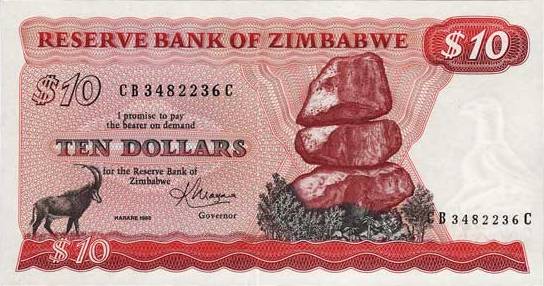

The Kombo Moyana ZWD series: 1983-1993

Moyana was appointed the first black governor of Zimbabwe’s central bank in 1983, serving until August 1993. During this time, Zimbabwe’s bank note remained the same, save for the new governor’s signature and the capital city’s new name, which had changed in 1982.

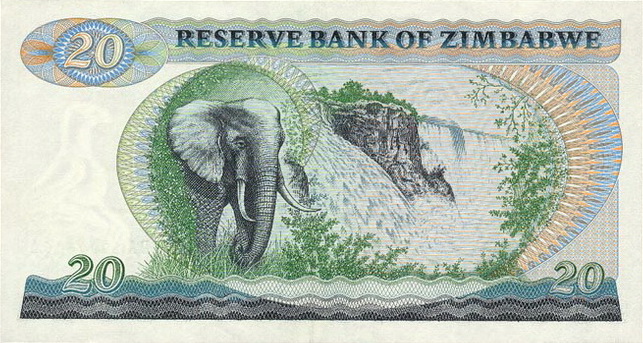

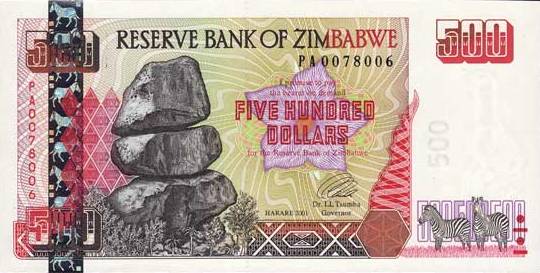

The Leonard Tsimba ZWD series: (1993-2003)

After succeeding Moyana in 1993, Tsumba introduced a new set of notes, starting with $50 and $100 denominations, between 1994 and 1995.

This was to be followed by new $5, $10 and $20 bills in 1997. A $500 note was introduced in 2001. A different $500 note, predominantly brown, replaced the red 2001 issue in 2003, when it was issued alongside a $1,000 bill.

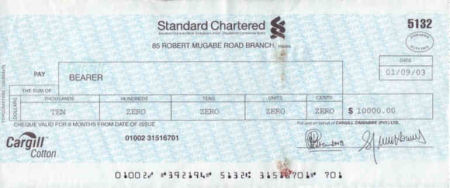

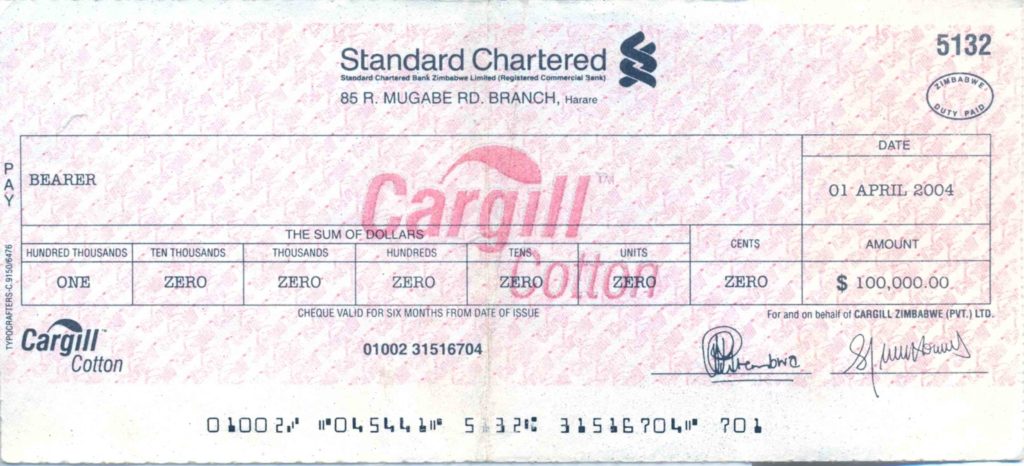

The Cargill Cotton bearer cheques: (2003-2004)

As inflation raced towards 600%, cotton company Cargill, whose supplier farmers were now burdened with huge stacks of dollars as payment, came up with “bearer cheques” issued by Standard Chartered bank with authorisation from the Reserve Bank of Zimbabwe. The first such bearer cheques were issued in June 2003 and were valid for six months.

The Cargill cheques, whose face value ranged between $5,000 and $100,000, were in circulation until October 2004.

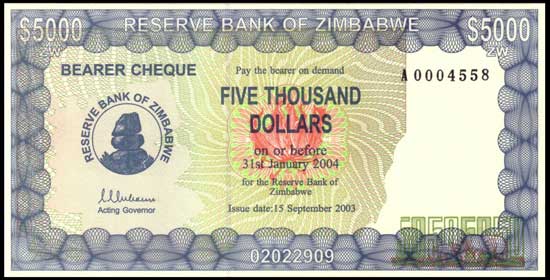

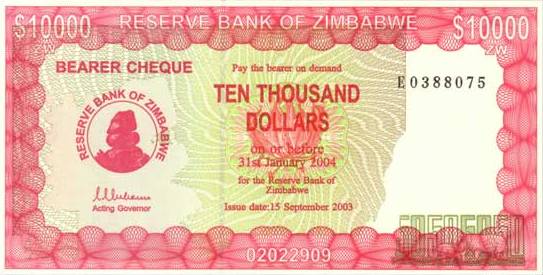

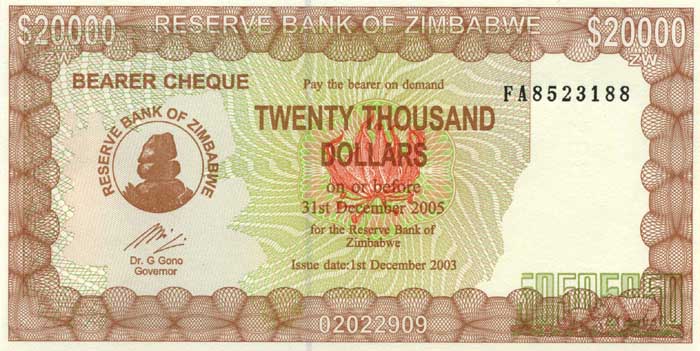

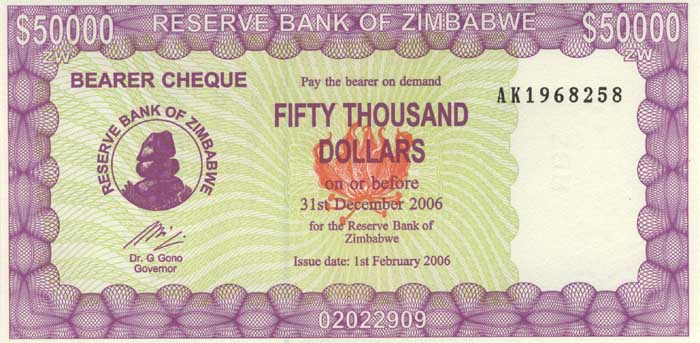

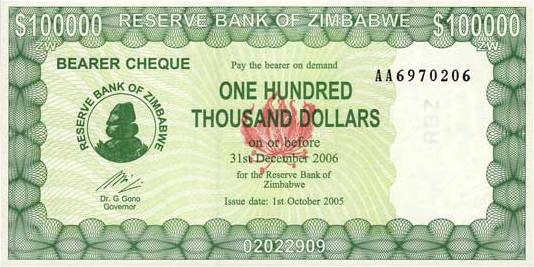

RBZ Bearer Cheques: (2003-2006)

Three months after the Cargill bearer cheques were introduced, primarily as payment instruments for cotton farmers, the Reserve Bank of Zimbabwe issued its own set of bearer cheques. The first RBZ bearer cheques, with face values of $5,000 and $10,000, were issued in September 2003 and carried the signature of the then Acting Governor, Charles Chikaura.

Gideon Gono signed subsequent issues of bearer cheques after his appointment in November 2003.

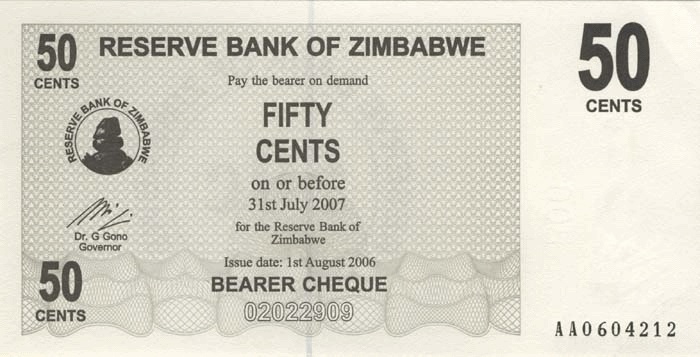

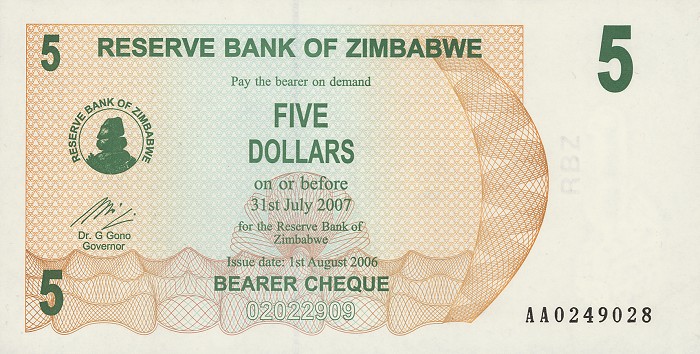

The first re-denomination ZWN bearer cheque series: (August 2006 – August 2008)

With inflation having vaulted above 1,000% that April, the Reserve Bank of Zimbabwe re-denominated its currency, dropping three zeroes from the rapidly devaluing dollar.

The re-denominated currency was designated ZWN under the International Organisation of Standardisation’s (ISO) currency codes.

The ZWN currency had 14 denominations, ranging from 1 cent to $100,000, bearing Gono’s signature.

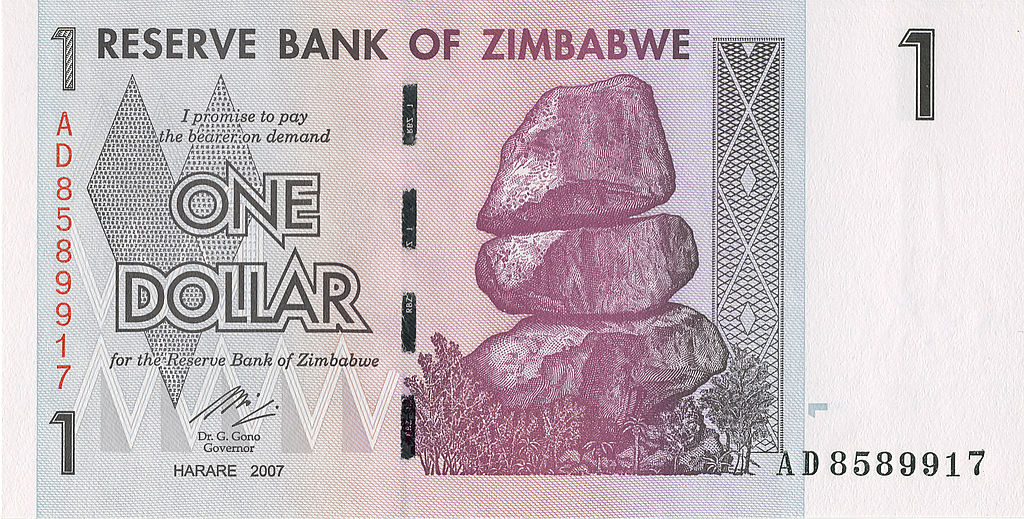

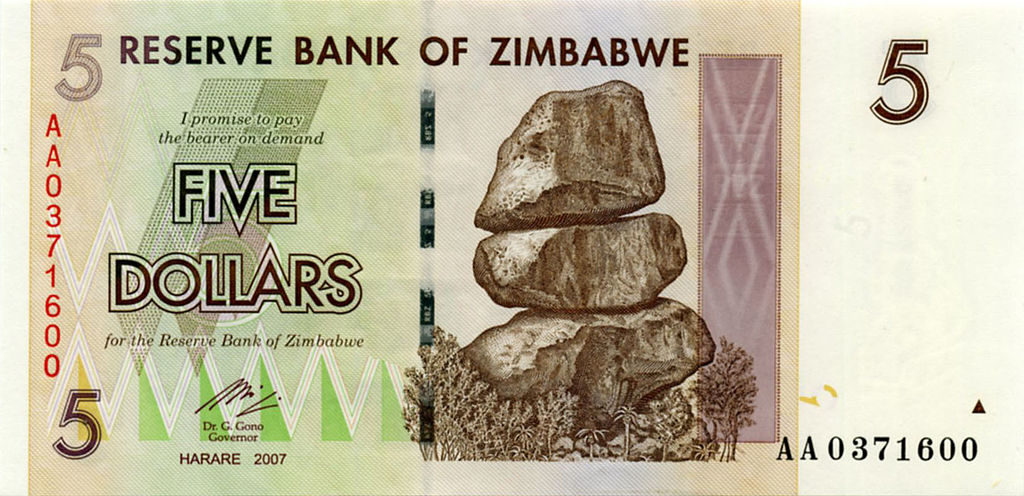

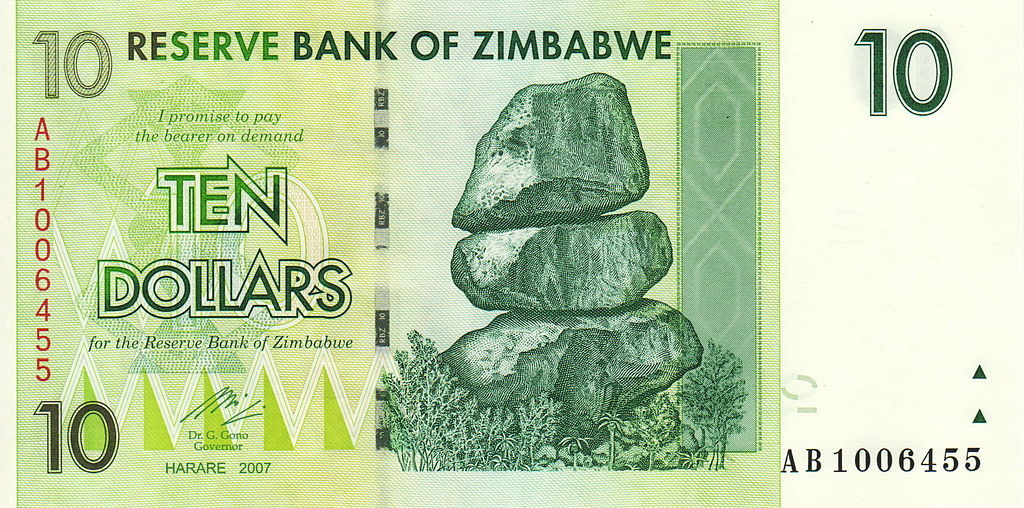

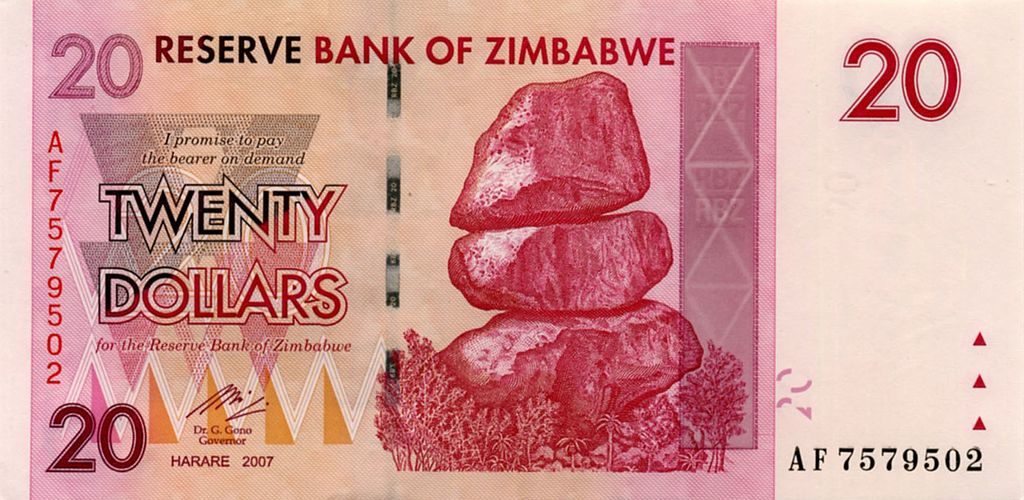

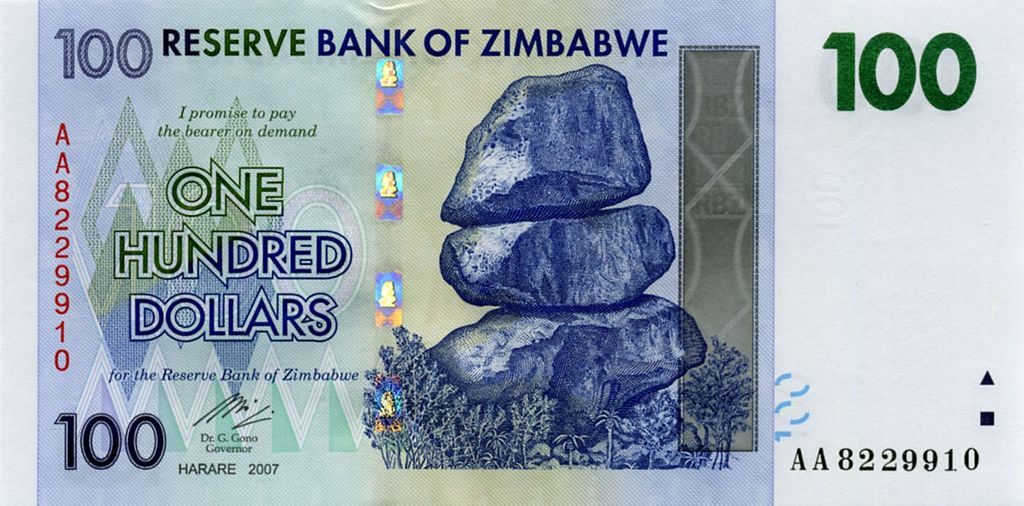

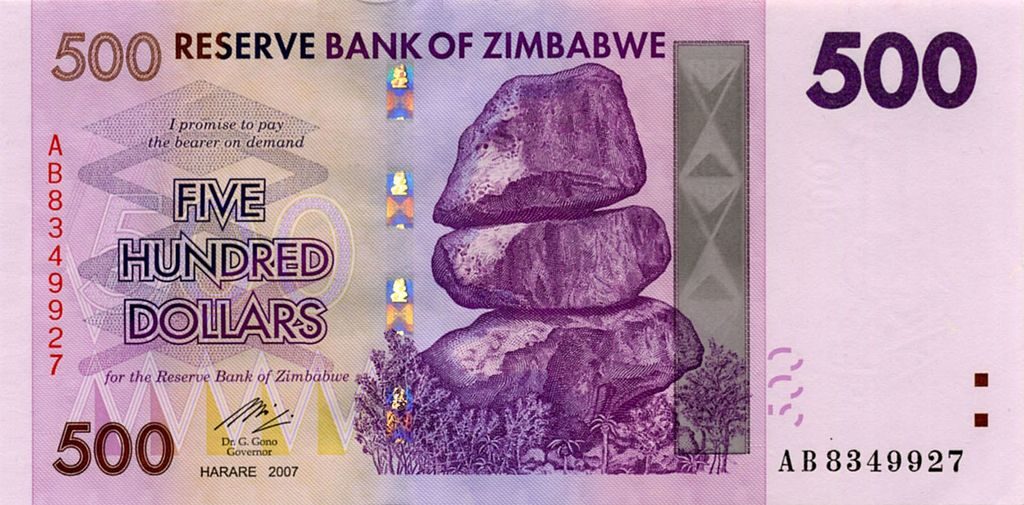

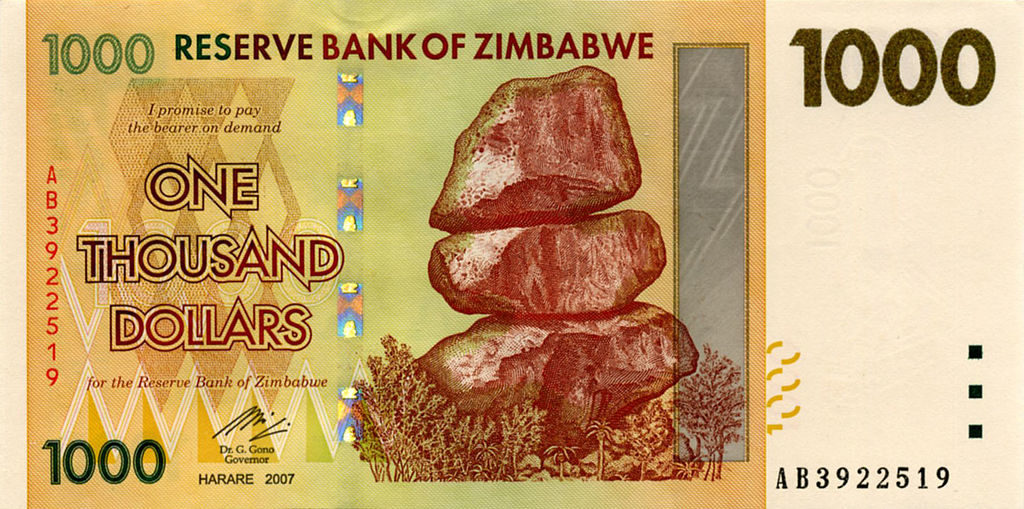

Abortive Sunrise 2 series: 2007

The bearer cheques introduced when three zeroes were dropped under the August 2006 RBZ Sunrise 1 project were supposed to be followed in 2007 by a new series of bank notes.

Raging hyperinflation forced the central bank’s hand. Instead of issuing the 2007 bank note series – ranging from $1 to $1,000, the RBZ introduced bearer cheques valued between $5,000 and $750,000.

However, when the RBZ re-denominated the currency by dropping 10 zeroes in August 2008, it is the the bank notes initially planned for Sunrise 2 that were injected into circulation between August 1, 2008 and December 31, 2008.

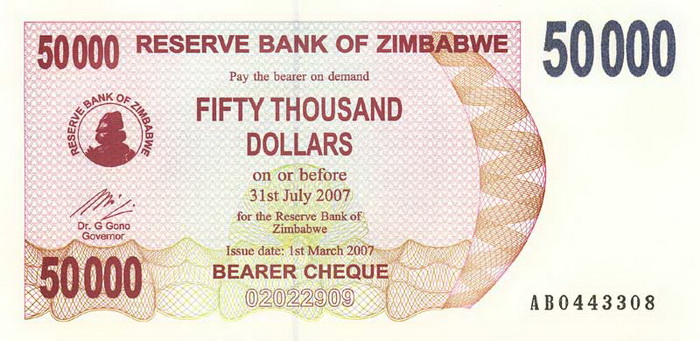

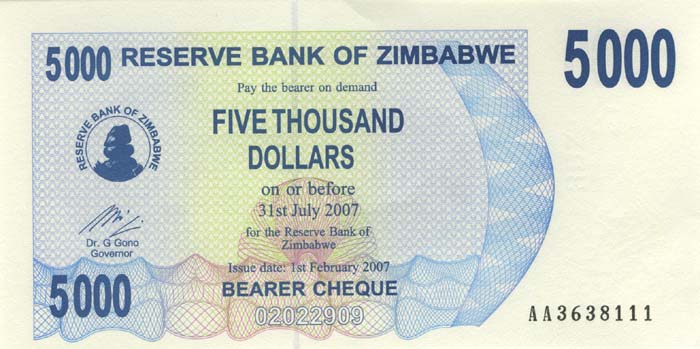

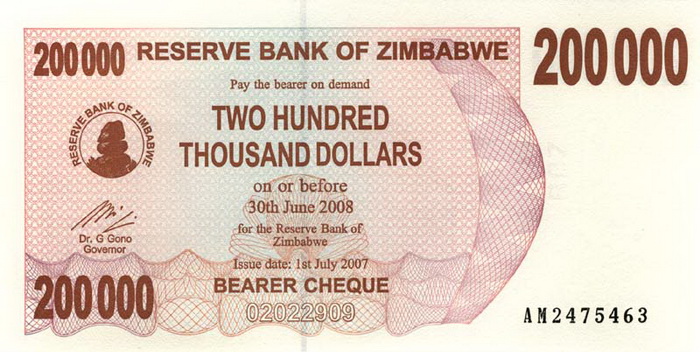

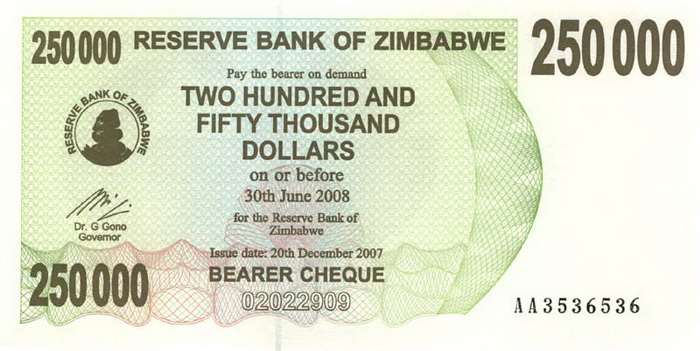

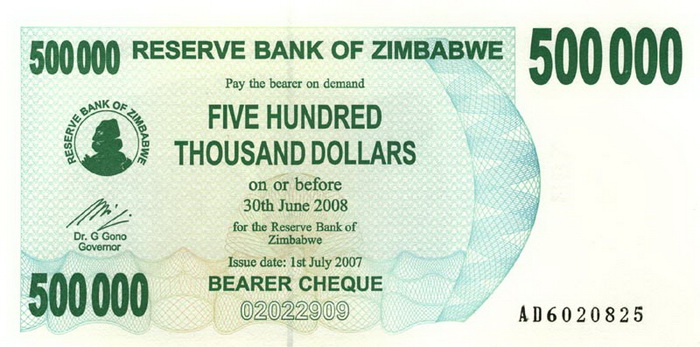

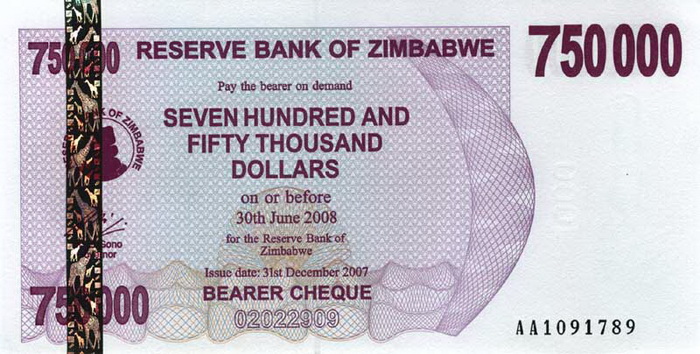

The 2007 bearer cheque series

Between March and December 2007, the central bank introduced bearer cheques ranging from $5,000 to $750,000.

The $5,000 and $10,000 bearer cheques were issued in March 2007 to help with change, as the previous issue had huge gaps between the $1,000, $10,000 and $100,000 notes.

By August 2007, as inflation accelerated, a $200,000 bearer cheque was issued, followed by $250,000, $500,000 and $750,000 notes that December.

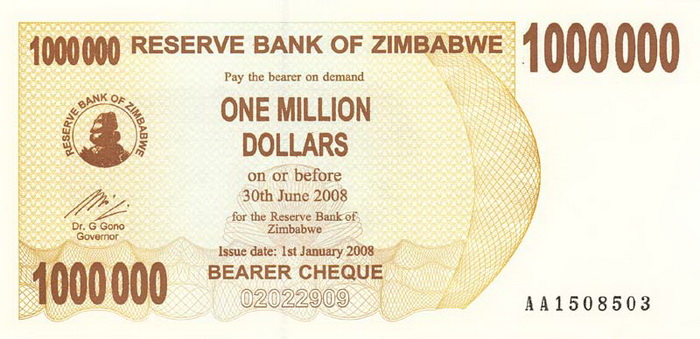

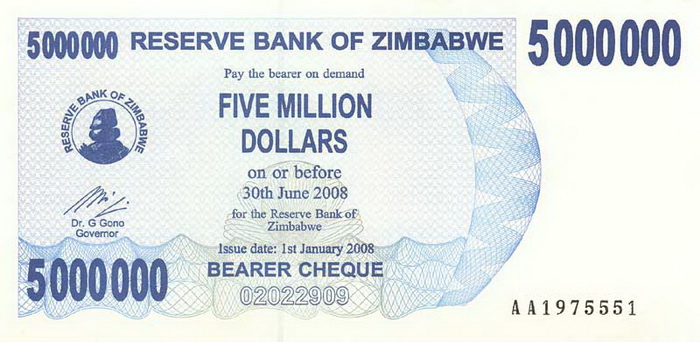

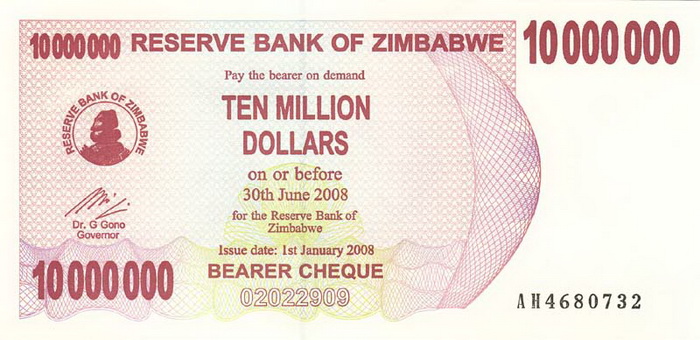

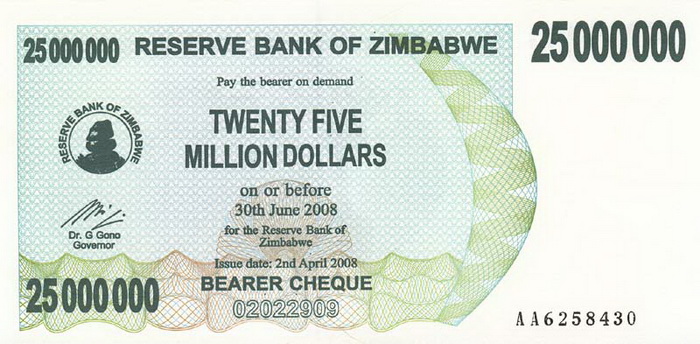

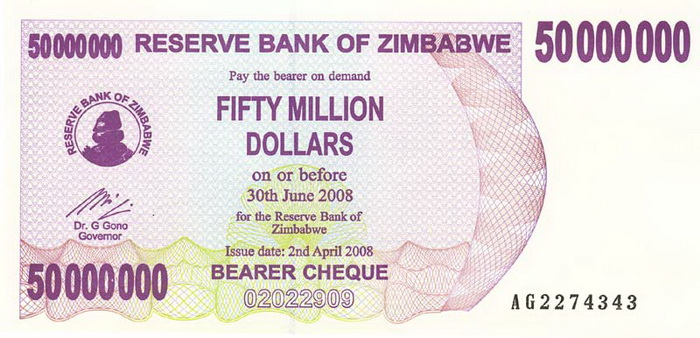

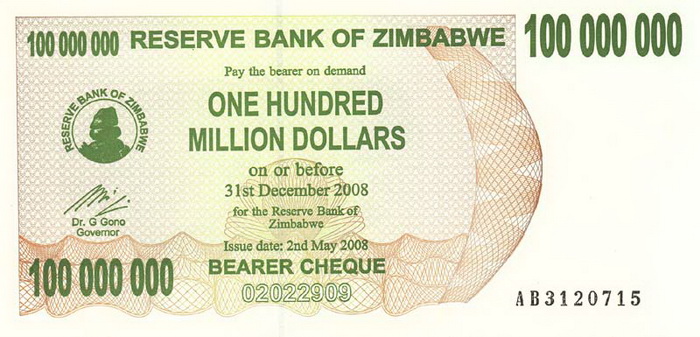

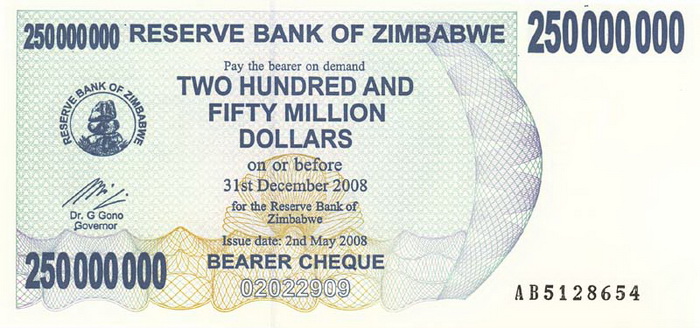

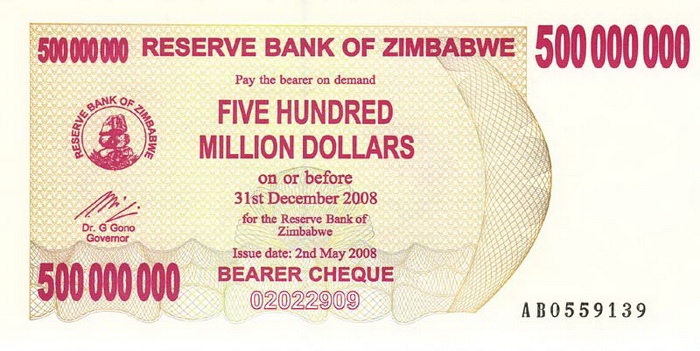

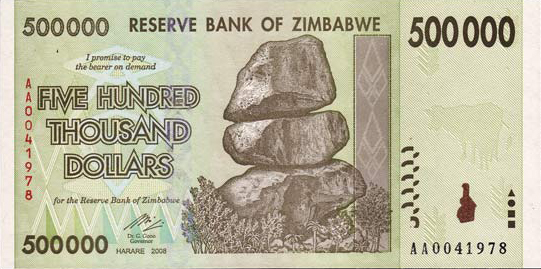

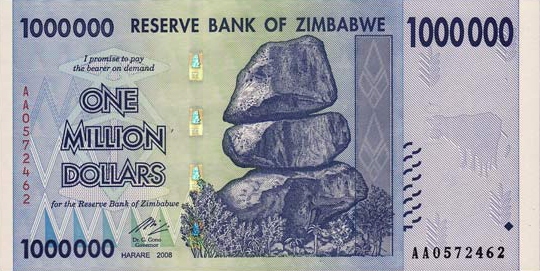

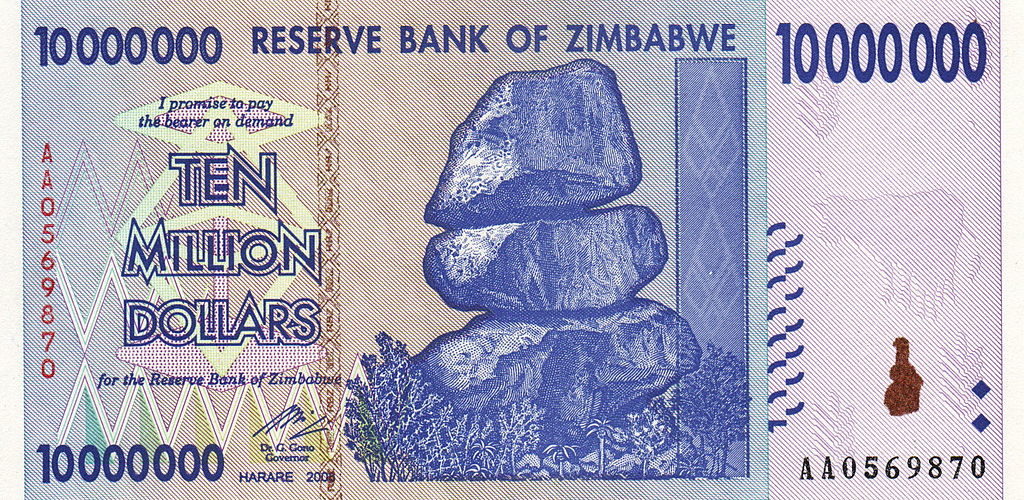

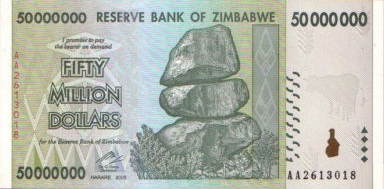

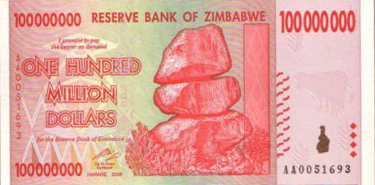

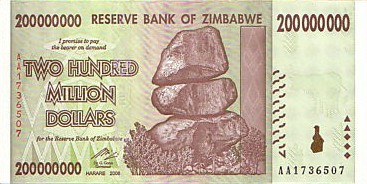

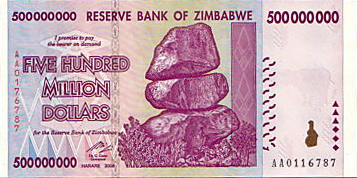

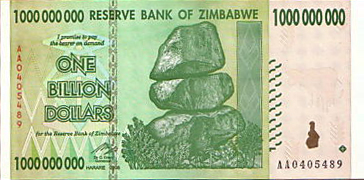

The 2008 bearer cheque series

Between January and May 2008, issued more bearer notes with values ranging from $1 million to $500 million.

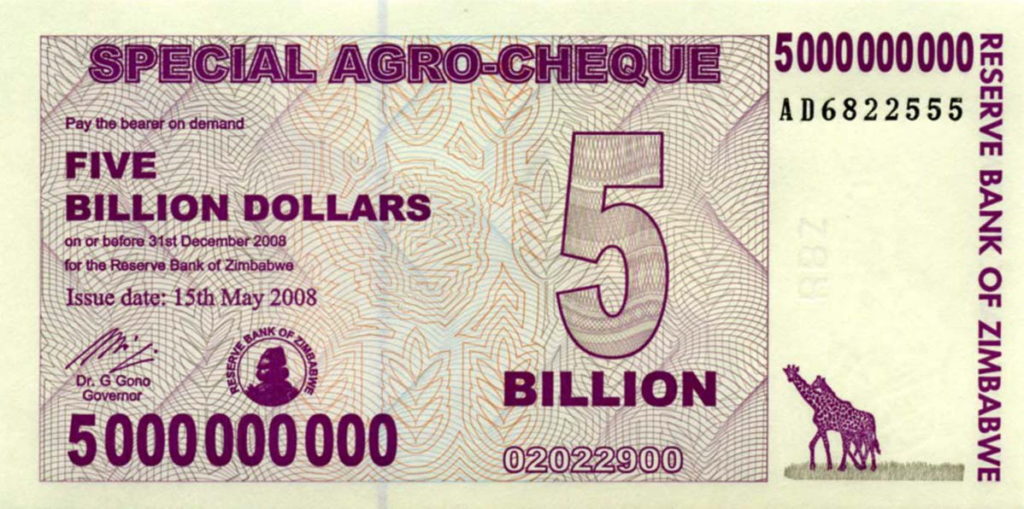

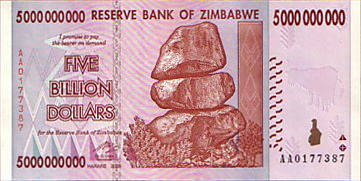

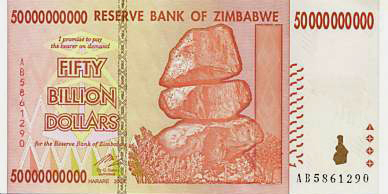

The Special Agro Cheques of 2008

As hyperinflation devoured the bearer cheques issued in 2007, the central bank introduced ‘special agricultural cheques’ – meant primarily to facilitate farmer payments. The agro cheques, which ranged from $5 billion to $100 billion, were injected into circulation between May and July 2008.

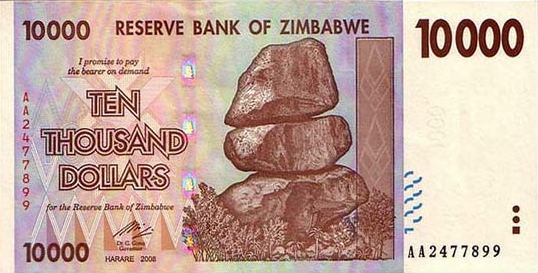

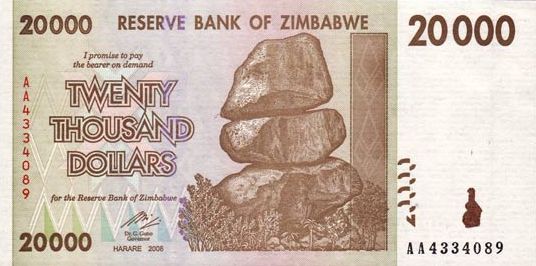

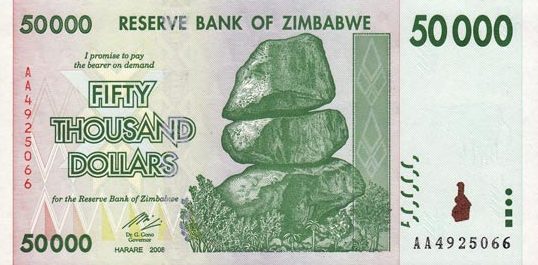

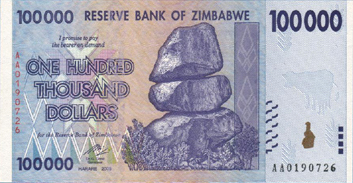

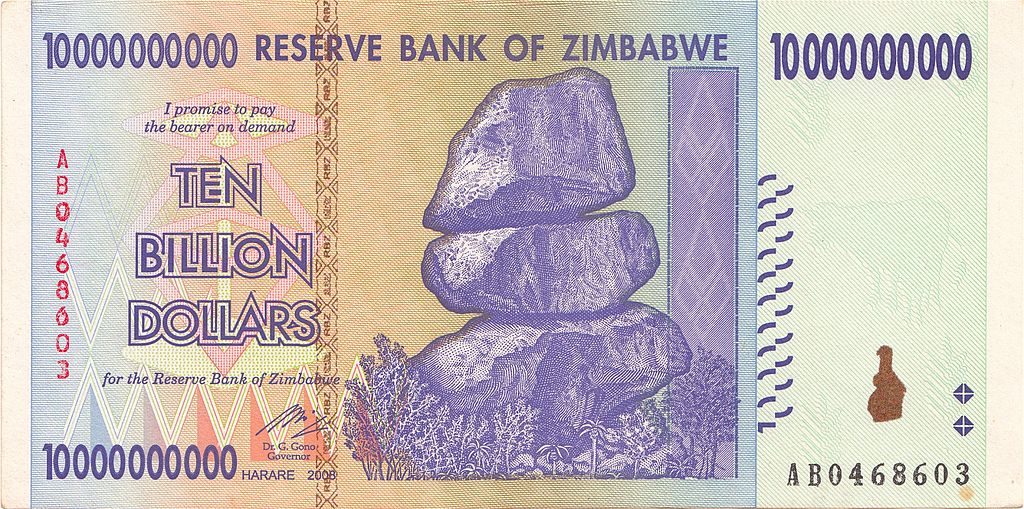

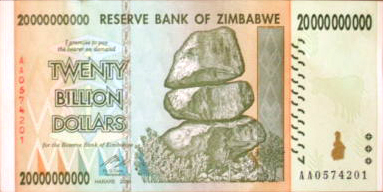

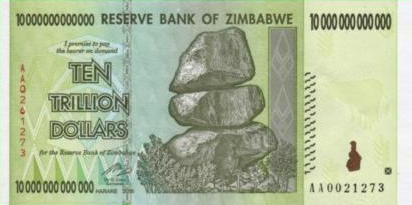

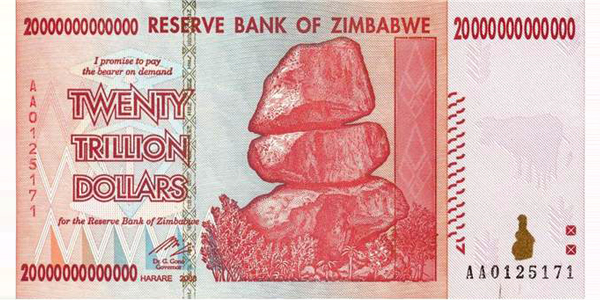

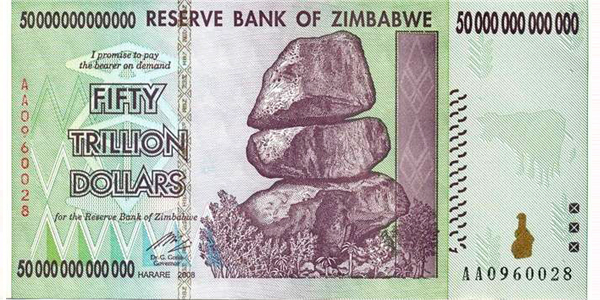

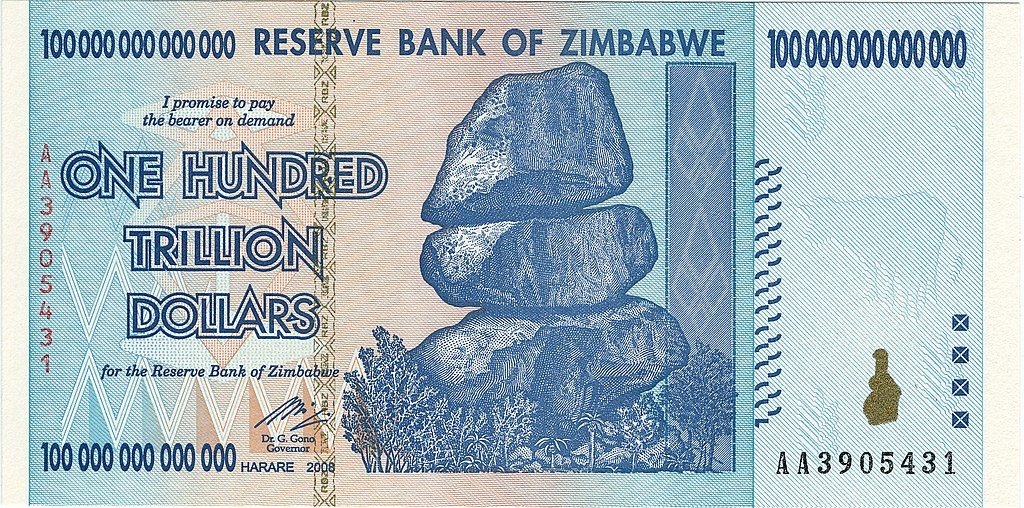

The Third Zimbabwe Dollar (ZWR): 2008-2009

As stated above, the third Zimbabwe dollar followed the lopping off of 10 zeroes from the currency on August 1, 2008. Bank notes initially planned for introduction in 2007, with values ranging from $1 to $1,000, were introduced between August and September 2008. By December 2008, these notes had been withdrawn from circulation.

With hyperinflation reaching a staggering 500 billion percent that December, according to the International Monetary Fund, the RBZ was once again forced to introduce higher denominations.

Between September and October 2008, notes ranging from $10,000 and $50,000 were brought into circulation. By November 2008, a $1 million note was in circulation and, by the end of 2008, the biggest note was worth $10 billion.

By January 16, 2009, Zimbabwe’s biggest ever note, the $100 trillion note, was brought into circulation. Still worth nothing more than a loaf of bread, the note was soon dumped as Zimbabwe formally adopted the use of multiple foreign currencies, mainly the United States dollar and South Africa’s rand, in a bid to tame hyperinflation.

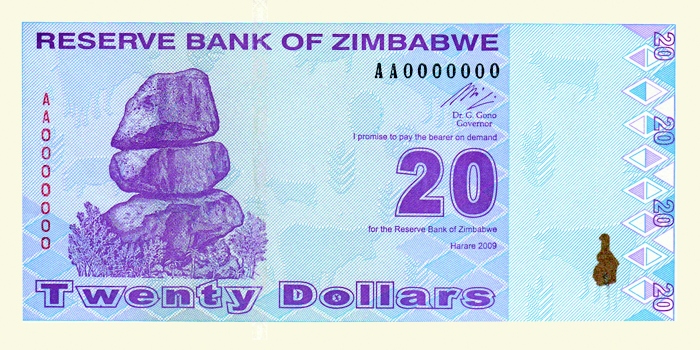

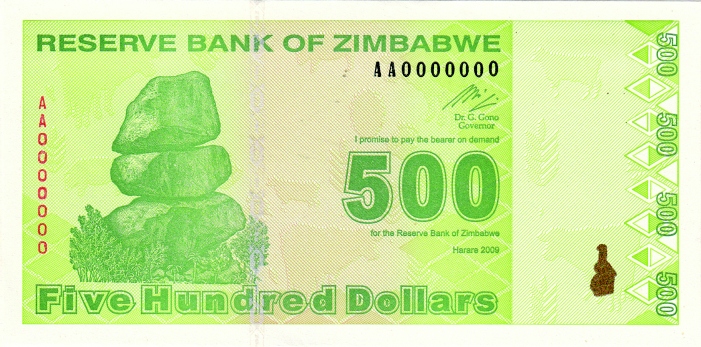

The shortlived fourth dollar (ZWL): February 2009 – April 2009

Even as the vast majority of the population had by now rejected the local currency, the RBZ once again re-denominated the currency, issuing new notes on February 2, 2009. This series was, however, short-lived as the country officially dollarised in February 2009.

A decade of dollarisation: 2009-2019

After its currency collapse of 2008, Zimbabwe adopted multiple currencies, mainly the US dollar and the rand.

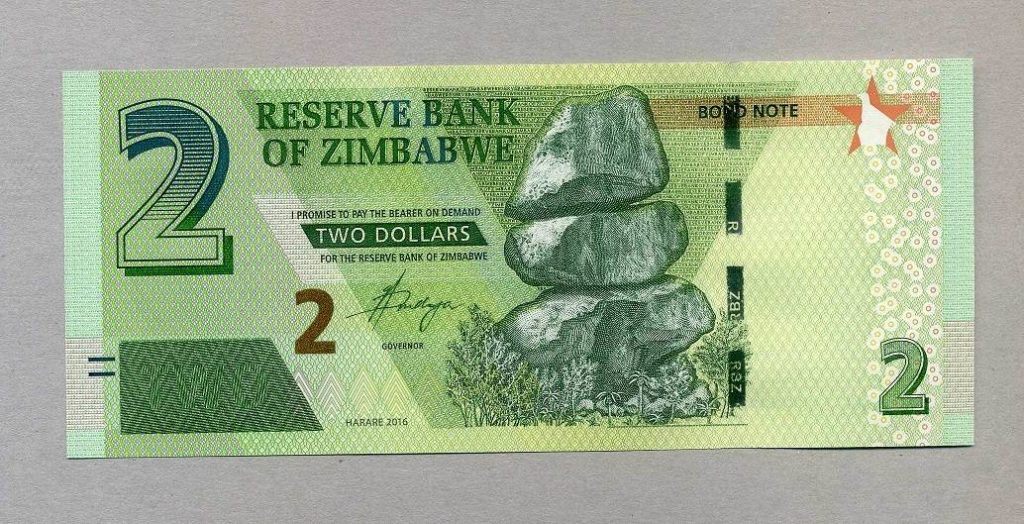

The Bond Note and Coin: 2016

While dollarisation ended hyperinflation overnight, Zimbabwe still had to contend with the shortage of bank notes and small change. In 2014, the RBZ, now under governor John Mangudya since 2013, introduced bond coins – so called because, according to the RBZ, the coins were backed by a African Export Bank bond facility. The coins, minted in were worth the equivalent value in US cents and dollars.

In May 2016, the RBZ announced it would introduce bond notes later that year in a bid to ease bank note shortages which had seen long lines re-emerging at banks during the latter part of 2015.

Like the coins before them, the bond notes would also be backed by an Afreximbank facility, while enjoying parity with the US dollar, the RBZ said.

Return of the Zimbabwe dollar: 2019

On October1, 2018, RBZ governor John Mangudya announced the separation of foreign currency deposits from bond note and local electronic deposits, thereby ending the officially sanctioned parity between the USD and what was to become an official local currency.

The October policy pronouncement was to be followed by the floating of the local currency in February 2009 and the official end of dollarisation with the outlawing of USD use in most local transactions, announced by Finance Minister Mthuli Ncube on June 24, 2019. This marked the official return of the Zimbabwe dollar, ten years after it had been replaced by multiple foreign currencies.

The authorities then announced that they would gradually introduce new bank notes into the economy, to circulate alongside the bond notes and coins already in issue. The new notes were introduced in November 2019.

Do you want to use our content? Click Here