CLAIM:

ZIMBABWE’S substantial population living and working in foreign countries is often credited with helping sustain the country’s economy through remittances.

Factchecked by Nelson Banya

Frequently, newspapers and public figures estimate Diaspora remittances into Zimbabwe to average US$1 billion every year.

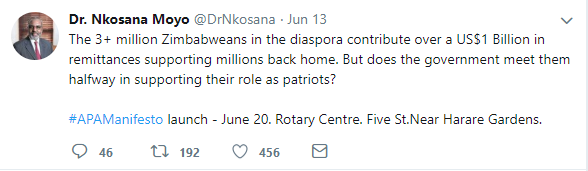

Recently, presidential candidate Nkosana Moyo of the Alliance for People’s Agenda cited the figure:

FINANCING DEVELOPMENT

The International Monetary Fund (IMF) defines remittances as “household income from foreign economies arising mainly from the temporary or permanent movement of people to those economies”.

Remittances have come to be acknowledged as a major source of financing for development in low to middle-income economies, such as Zimbabwe.

According to the World Bank, migrant remittances into developing countries amounted to US$429 billion in 2016, exceeding official development assistance (ODA), in addition to being more stable than private capital flows.

Remittance flows into sub-Saharan Africa’s economies were expected to inject US$34 billion in 2017, according to World Bank projections.

Both the IMF and World Bank acknowledge the difficulties in compiling accurate remittance data, particularly in countries such as Zimbabwe, where unconventional channels are used to move funds.

The biggest segment of Zimbabwe’s non-resident population – a significant portion of which is undocumented – is in South Africa. These Zimbabweans are likely to rely on informal money transfer methods to send funds back home, meaning the official data provides an incomplete picture.

Zimbabwe’s data, sourced from the central bank, is largely drawn from banks and official money transfer agents.

CONFLATED DATA

Zimbabwe ranks highly among global remittance recipient countries, according to the World Bank’s 2016 data.

The country is ranked 36th in the world and fifth in Africa, behind Nigeria, Egypt, Morocco and Ghana.

However, the World Bank’s 2016 remittance data for Zimbabwe, US$1.853 billion appears to be the total international transfers into the country, incorporating humanitarian assistance and migrant remittances.

In Zimbabwe’s case, humanitarian assistance consistently exceeds diaspora remittances, although the two combine to propel total transfers into the country over the US$1 billion mark annually.

Zimbabwean authorities often conflate the two strands together when they publish remittance statistics, frequently leading to confusion and overstatement of diaspora remittances.

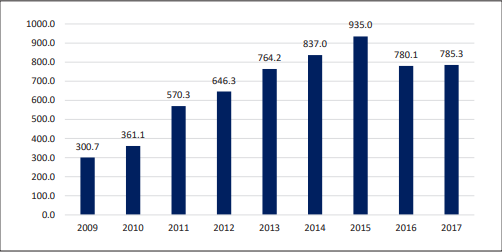

Source: Reserve Bank of Zimbabwe/Ministry of Finance

CONCLUSION

The claim that Zimbabweans living and working abroad send in excess of US$1 billion back home every year is not accurate.

Since 2009, when the country adopted the use of foreign currencies, chiefly the United States dollar and South Africa’s rand, diaspora remittances peaked at US$935 million in 2015.

The notion that migrant remittances exceed US$1 billion seems to stem from the tendency, in some official reporting, to incorporate humanitarian assistance into the numbers.

Nelson Banya is Deputy Editor of ZimFact

Do you want to use our content? Click Here