President Emmerson Mnangagwa with Afreximbank President Benedict Oramah in August 2019. Photo: newziana

CLAIM: The African Export Import Bank (Afreximbank) has lent more than half its balance sheet to Zimbabwe.

Source: A post by former Zimbabwe finance minister Tendai Biti on Twitter.

VERDICT: Incorrect. No single region, let alone country, accounts for even half of Afreximbank’s total loans, according to the continental bank’s latest financial information.

In an October 7, 2020 Tweet, former finance minister Tendai Biti said Afreximbank was “obscenely over exposed” to Zimbabwe.

“More than half it’s (sic) balance sheet has been lent to Zim. This is abnormal and terrible governance,” Biti claimed.

The Afreximbank loan book

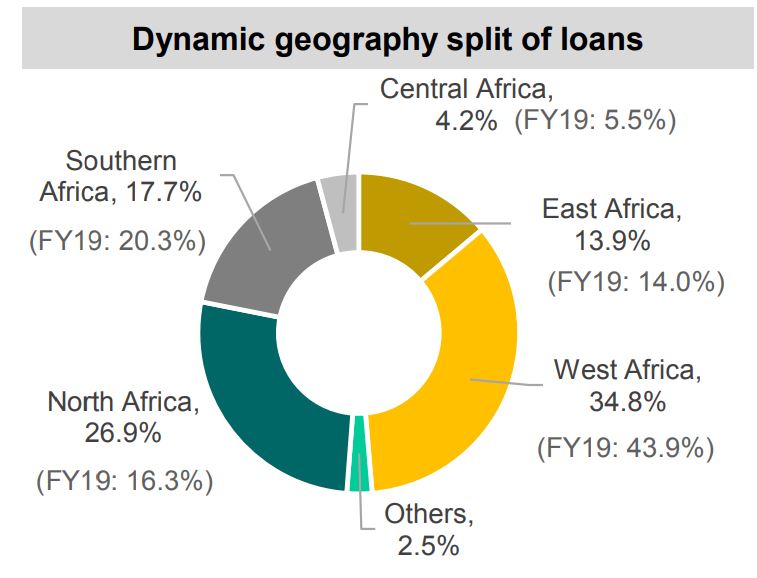

According to the bank’s latest financial statements, Afreximbank’s loans amounted to US$15.2 billion at the end of June 2020.

Of this amount, Southern Africa, Zimbabwe’s region, accounts for US$2,78 billion.

This is just over 18% of Afreximbank’s total loans.

The bank does not break the loan data down to country level.

With US$5,45 billion loans, West Africa gets the biggest portion of Afreximbank loans, 35%, followed by North Africa with US$4,22 billion or 27%.

East Africa and Central Africa account for US$2,17 billion (14%) and US$655 million (4%), respectively.

Most of Afreximbank loans go to the financial sector, whose share stood at 55% at the end of June 2020. Lending to central banks amounted to US$3.34 billion or 22% of total loans.

Afreximbank says the quality of its loans remains within target. Non-performing loans made up 3.47% of the total book at the end of June, below the bank’s target ceiling of 4%.

Independent assessments of Afrex loans

Banks such as Afreximbank are subjected to ratings by rating agencies, such as Fitch and Moody’s. These companies assess a bank’s loans and give independent evaluations.

In a report released on September 11, 2020, Fitch said in terms of loans to countries, Gabon, Kenya, Nigeria, and Zambia account for 41% of the bank’s loans. Zimbabwe does not feature on Fitch’s list of countries with the largest loans.

Fitch also said Afreximbank’s concentration risk – the risk of lending too much to one particular customer – is rated “low”. The bank’s five largest exposures accounted for 26% of the bank’s total portfolio at the end of 2019.

Moody’s, another rating agency, issued its own report on July 14, 2020.

According to Moody’s, Afreximbank’s loan portfolio’s concentration levels in terms of Top 10 exposures, by geography and sector, are “in the medium range” compared with other similar banks. The Top 10 receivers of Afrex loans account for less than 50% of the bank’s total loans, Moody’s says.

Zimbabwe and Afreximbank

Afreximbank has emerged as a leading source of loans for Zimbabwe, which has been frozen out of international capital markets for more than two decades.

Although Afreximbank also extends credit lines to private Zimbabwean companies, the bulk of its lending to the country goes to the government through the central bank.

The Reserve Bank of Zimbabwe’s total foreign debt stood at nearly US$4,8 billion in July 2020, according to its latest available monthly economic report.

The central bank does not provide details of individual sources of the debt, although RBZ governor John Mangudya told Parliament in March 2019 that Zimbabwe had borrowed US$985 million from African lenders, including US$641 million from Afreximbank in 2018.

Conclusion

While Afreximbank has emerged as a leading lender to Zimbabwe, Biti’s claim that the continental bank has lent “more than half of its balance sheet” to the country is false.

The bank’s greatest exposure is to West Africa, which still accounts for less than half of Afreximbank’s loan book.

Do you want to use our content? Click Here