There has been a growing concern over the imminent threat of global warming due to increased emission of carbon fuels into the atmosphere which has accelerated the effects of climate change.

The International Energy Agency reported that in 2023, carbon emissions increased by 1.1 percent to reach a global record of 37.4 billion tonnes. Of these emissions, Africa is said to be responsible for just 4 percent according to the United Nations Framework Convention on Climate Change

As a result of the world’s growing carbon footprint, countries have come together to devise mechanisms to deter heavy emitters of carbon and to incentivise actors who contribute to conservation of the environment through a system of carbon credits. This factsheet explores facts on how carbon credits work to help conserve the environment.

What is Zimbabwe doing to cut back on carbon emissions?

In 2023, Zimbabwe took a significant step towards a greener and more sustainable future by introducing groundbreaking legislation, Statutory Instrument 150 of 2023, which regulates the thriving carbon credits trading industry.

The Minister responsible for Climate Change Management in terms of section 140(2)(c) of the Environmental Management Act, made regulations that are cited as the Carbon Credits Trading (General) Regulations, 2023.

According to the Zimbabwe Forestry Commission, carbon credit trading is an effective mechanism that enables countries and organizations to offset their carbon emissions by investing in clean energy projects and initiatives.

What are Carbon Credits?

A carbon credit is a permit which allows a country or organization to produce a certain amount

of carbon emissions, which can be traded if the full allowance is not used.

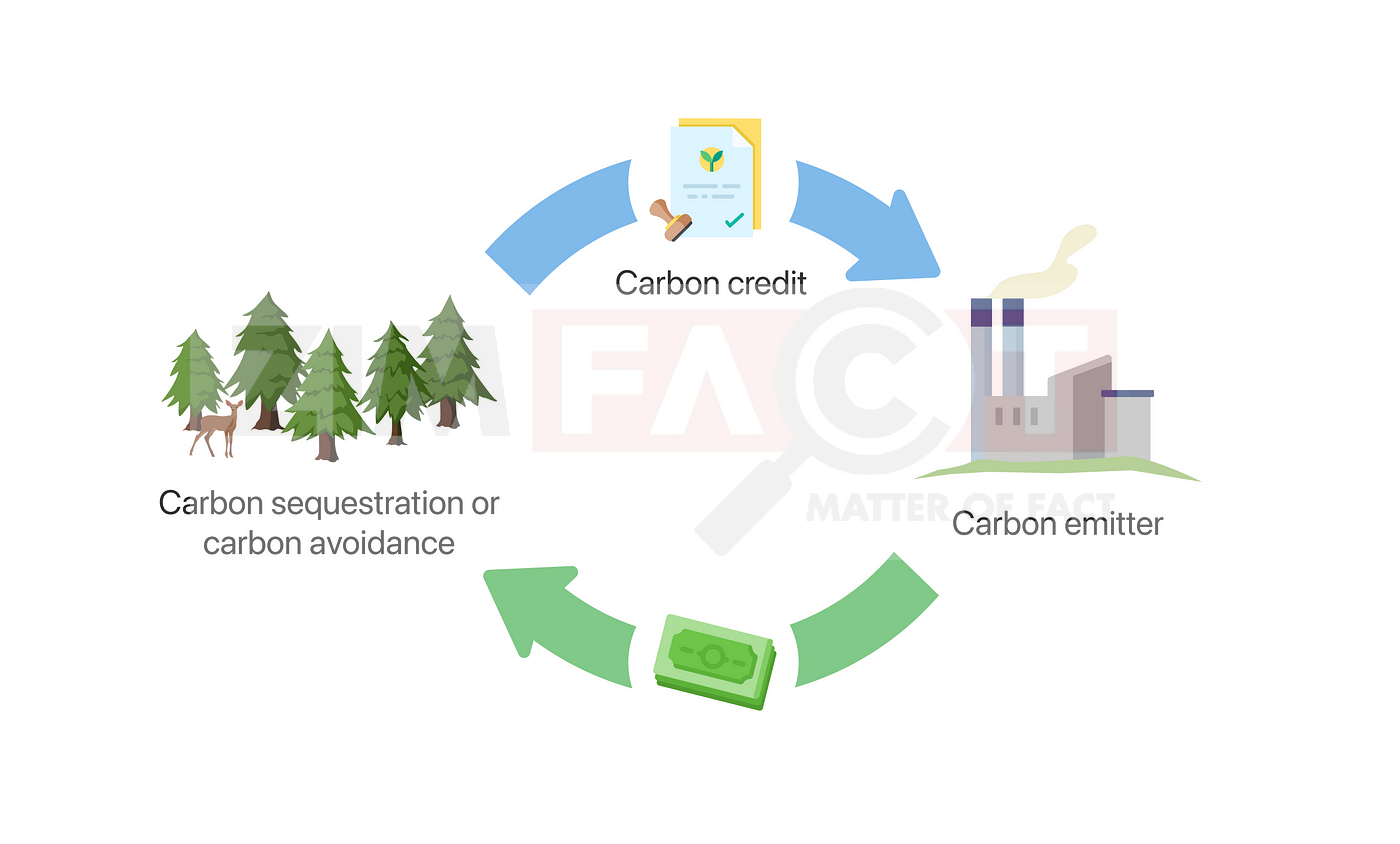

Put simply, carbon credits work like permission slips for emissions. When a company buys a carbon credit, usually from the government, they gain permission to generate one tonne of CO2 emissions according to CarbonCredits.com.

How do carbon credits work?

- One carbon credit represents one tonne of Carbon dioxide or its equivalent (CO2e) gas that an organization can emit.

- The number of credits issued to a company corresponds to its emissions limit or “cap” set by a regulatory body.

- If a company does not go above its cap, then it will have excess carbon credits which they can sell in the compliance carbon market regulated by the government.

- But, if the company goes beyond the limit, it can turn to the carbon market to buy the required carbon credits.

- Over-emitters buy carbon credits from under-emitters.

What is the carbon marketplace?

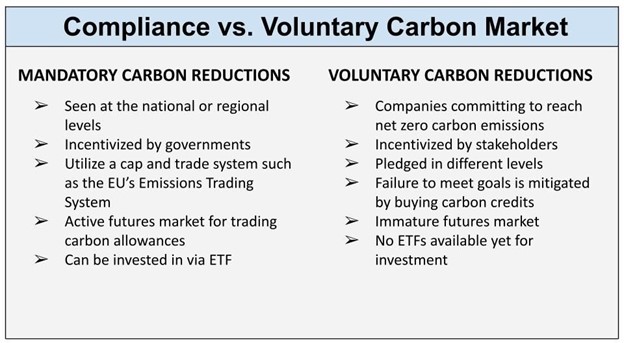

There are two significant, separate markets to choose from:

One is a regulated market, set by “cap-and-trade” regulations at the regional and state levels. The other is a voluntary market where businesses and individuals buy credits (of their own accord) to offset their carbon emissions.

How to produce Carbon Credits (Carbon offsets)

Carbon offsets (also called carbon offset credits) are from projects or initiatives that reduce or remove carbon emissions.

Carbon reduction projects generally fall into two types which nature-based and technology-based.

Nature-based solutions usually include reforestation and wetland restoration projects. They naturally sequester carbon in the environment.

Technology-based projects often involve investments in new technologies that increase efficiencies or reduce emissions like renewable energy projects.

Once an offset is generated, the organization that develops or completes the project can retain the offsets or trade them on a Voluntary Carbon Market (VCM).

Some of the most popular types of carbon offsetting projects include:

- Renewable energy projects,

- Improving energy efficiency,

- Carbon and methane capture and sequestration,

- Land use and reforestation,

- Renewable energy projects,

- Energy efficiency improvements

- Carbon and methane capture

- Land use and reforestation projects

Where can one buy Carbon Credits?

- Directly from project developers

- Brokers

- Retailers

Sources

Carbon Credits Trading (General) Regulations 2023

https://carboncredits.com/how-you-can-benefit-from-the-booming-carbon-credits-market

https://carboncredits.com/carbon-offsets-rating-provider-sylvera-raises-32-6m-in-series-a-round

Zimbabwe Forestry Commission

Related Content

Do you want to use our content? Click Here